Analysts believe that staking capabilities for Ethereum exchange-traded funds will open the floodgates for institutional capital.

Source: X (@NateGeraci)

Markus Thielen, Head of Research at 10x Research, said that adding staking to Ether ETFs could “dramatically reshape the market” by increasing overall yield and offering stronger value propositions to investors.

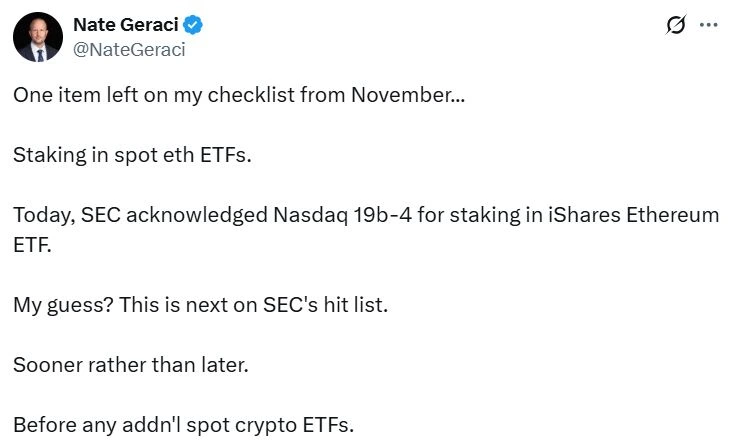

Currently, U.S.-listed Ethereum ETFs are still under review by the Securities and Exchange Commission (SEC), which has yet to approve staking functionalities. However, recent developments, such as the SEC acknowledging Nasdaq’s application to add staking to BlackRock’s iShares Ethereum ETF, suggest that approval may not be far off.

Thielen pointed out that the existing basis trade between spot Ether ETFs and Ethereum futures already offers a 7% annualized return. If staking were approved, this could add another 3% yield, taking the total potential return to 10% annually without leverage.

This potential increase in returns could lead to a structural shift in how institutional capital is allocated within the crypto space.

Ryan McMillin, Chief Investment Officer at Australian firm Merkle Tree Capital, believes staking could make Ethereum ETFs significantly more appealing to institutions. Unlike Bitcoin, which serves as a digital gold asset, Ethereum offers a more dynamic role in the crypto ecosystem.

He explained that pension funds and other long-term institutional investors often prioritize steady income over uncertain capital gains. A 3–5% staking yield, combined with Ethereum’s infrastructure role in decentralized finance, makes it a “unique and compelling” portfolio addition.

Hank Huang, CEO of Kronos Research, emphasized that staking approval will do more than just enhance returns—it could dramatically increase onchain participation and liquidity.

Huang said:

“Ether ETFs offering yield plus asset growth flips the switch on demand. These ETFs will pull in serious capital and drive higher valuations across the ecosystem.”

Source: X (@JSeyff)

By providing a compliant, custodial-free option to earn staking rewards, these products could appeal to institutions wary of handling private keys or interacting directly with DeFi protocols.

Huang added that a staking-enabled Ethereum ETF with flexible exit options and reliable yield would set a new gold standard in crypto investing.

He explained:

“This kind of ETF would raise the bar for the entire sector and pave the way for more mainstream adoption.”

Such a development could act as a bridge between traditional finance and decentralized ecosystems, making Ethereum not just an asset but a platform for yield generation and innovation.

An Ethereum ETF is an exchange-traded fund that tracks the price of Ethereum (ETH), allowing investors to gain exposure without directly holding the asset.

As of mid-2025, Ethereum ETFs in the U.S. are not yet authorized to offer staking. However, applications from major firms like BlackRock are under review by the SEC.

Staking allows ETH holders to earn rewards by participating in the network’s security. Adding staking to ETFs means those funds could earn passive income, boosting overall returns for investors.

Institutions often avoid holding crypto directly due to security and regulatory concerns. An ETF with staking provides a regulated, simplified way to earn yield without direct custody of assets.

Increased institutional participation could enhance liquidity, raise ETH demand, and contribute to price appreciation. It also encourages broader onchain activity.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.043.70%

Figure Heloc(FIGR_HELOC)$1.043.70% Wrapped stETH(WSTETH)$3,700.14-3.32%

Wrapped stETH(WSTETH)$3,700.14-3.32% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.03% Hyperliquid(HYPE)$31.32-6.75%

Hyperliquid(HYPE)$31.32-6.75% WETH(WETH)$3,030.00-3.34%

WETH(WETH)$3,030.00-3.34% Wrapped eETH(WEETH)$3,280.98-3.32%

Wrapped eETH(WEETH)$3,280.98-3.32% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Coinbase Wrapped BTC(CBBTC)$89,467.00-3.29%

Coinbase Wrapped BTC(CBBTC)$89,467.00-3.29% sUSDS(SUSDS)$1.07-0.60%

sUSDS(SUSDS)$1.07-0.60% World Liberty Financial(WLFI)$0.150285-1.89%

World Liberty Financial(WLFI)$0.150285-1.89% USDT0(USDT0)$1.00-0.03%

USDT0(USDT0)$1.00-0.03% Ethena Staked USDe(SUSDE)$1.210.02%

Ethena Staked USDe(SUSDE)$1.210.02% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% Bittensor(TAO)$274.32-6.45%

Bittensor(TAO)$274.32-6.45% MemeCore(M)$1.32-0.47%

MemeCore(M)$1.32-0.47%