While older traders may still rely on gut instincts or manual chart analysis, Gen Z is taking a different approach. For them, AI isn’t a gimmick, it’s a competitive advantage.

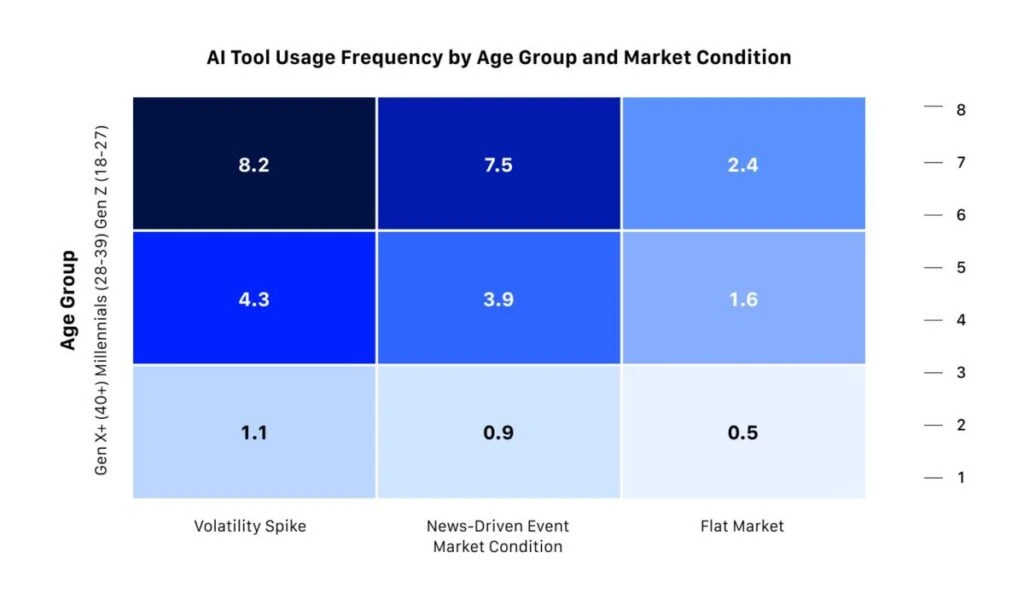

AI Tool Usage Frequency By Age Group & Market Condition

Source: MEXC

From setting conditional orders to managing portfolios in real time, AI bots allow for faster decisions and reduced emotional interference.

Here are some statistics:

Rather than simply automating tasks, Gen Z traders use AI as a psychological buffer. By letting bots handle high-stress situations, traders experience 47% fewer panic sells, according to MEXC.

One trader commented:

“We’re not just using AI to save time—we’re using it to save our sanity.”

One of the most striking insights from the report is how AI crypto trading tools act as a built-in risk management framework. During periods of price instability, Gen Z traders are:

This shows that AI is enhancing discipline, not eliminating control. These users aren’t blindly trusting automation, they’re strategically deploying it based on market behavior.

Another notable trend is that Gen Z traders often deactivate bots during sideways or low-volume markets, suggesting a high level of strategic awareness.

This isn’t about letting AI take over, it’s about knowing when AI adds value and when it doesn’t.

For Gen Z, AI crypto trading tools are seen as co-pilots rather than replacements. These systems augment decision-making, allowing traders to delegate routine processes while maintaining oversight.

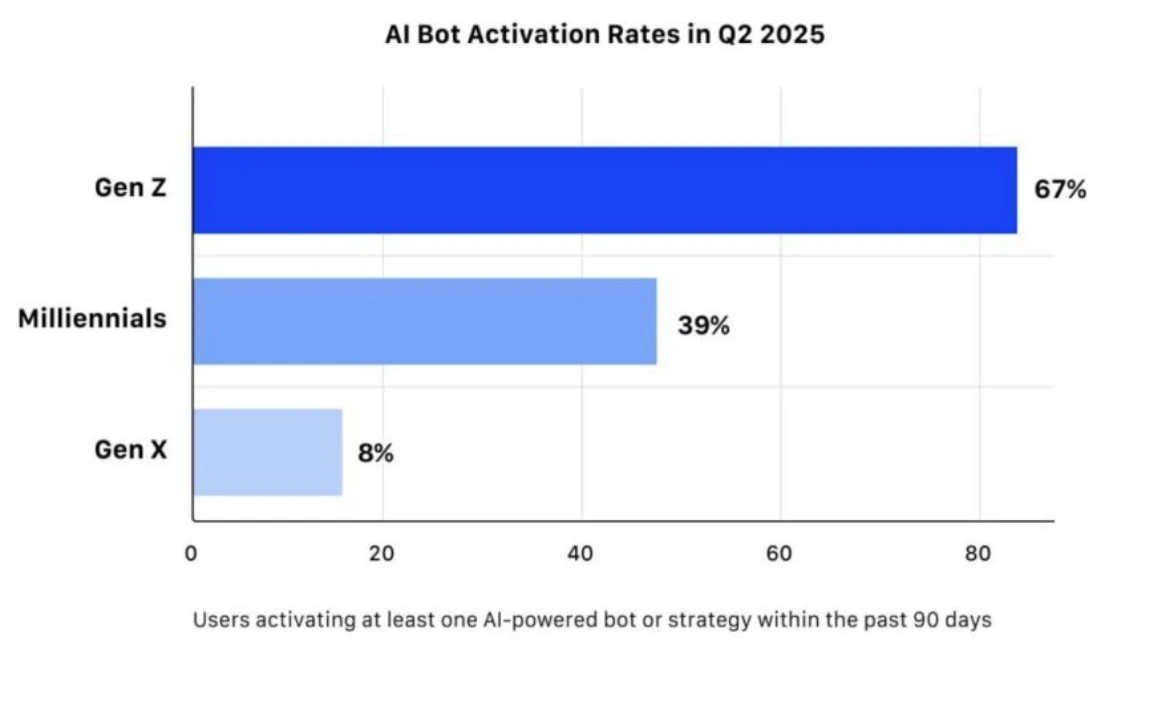

Source: MEXC

Recent studies, like one from Resume.org, reveal that many young users actually find AI more approachable than human managers, highlighting a broader generational comfort with intelligent systems.

As AI tools evolve, the trend toward semi-automated, emotionally intelligent investing is expected to deepen. Gen Z is pioneering a model that blends:

With AI trading tools becoming more accessible and adaptive, this could mark the beginning of a new standard for crypto risk management and portfolio strategy.

AI crypto trading involves the use of artificial intelligence and machine learning tools, like trading bots or predictive algorithms, to automate and optimize cryptocurrency trading strategies.

Gen Z has grown up in a digital-first world and is more comfortable integrating technology into financial decisions. They value automation, speed, and emotional control, areas where AI tools excel.

While no tool can guarantee profits, reputable AI bots with customizable strategies and risk controls can enhance trading performance. It’s important to understand how each tool works and use them strategically.

Not necessarily. Many platforms like MEXC offer user-friendly AI bots with visual interfaces, making them accessible even for beginners.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.24%

Figure Heloc(FIGR_HELOC)$1.030.24% USDS(USDS)$1.00-0.05%

USDS(USDS)$1.00-0.05% Hyperliquid(HYPE)$31.20-5.54%

Hyperliquid(HYPE)$31.20-5.54% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.156598-1.88%

Canton(CC)$0.156598-1.88% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009163-0.06%

Rain(RAIN)$0.009163-0.06% World Liberty Financial(WLFI)$0.103966-1.20%

World Liberty Financial(WLFI)$0.103966-1.20% MemeCore(M)$1.40-3.95%

MemeCore(M)$1.40-3.95% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Circle USYC(USYC)$1.120.04%

Circle USYC(USYC)$1.120.04% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02% Falcon USD(USDF)$1.000.02%

Falcon USD(USDF)$1.000.02% Bittensor(TAO)$181.00-0.47%

Bittensor(TAO)$181.00-0.47% Aster(ASTER)$0.700.52%

Aster(ASTER)$0.700.52% Pi Network(PI)$0.1714870.11%

Pi Network(PI)$0.1714870.11% Sky(SKY)$0.0704931.65%

Sky(SKY)$0.0704931.65%