Google Gemini, formerly known as Bard, offers traders a smarter, faster way to process breaking crypto news, understand sentiment, and form trade theses.

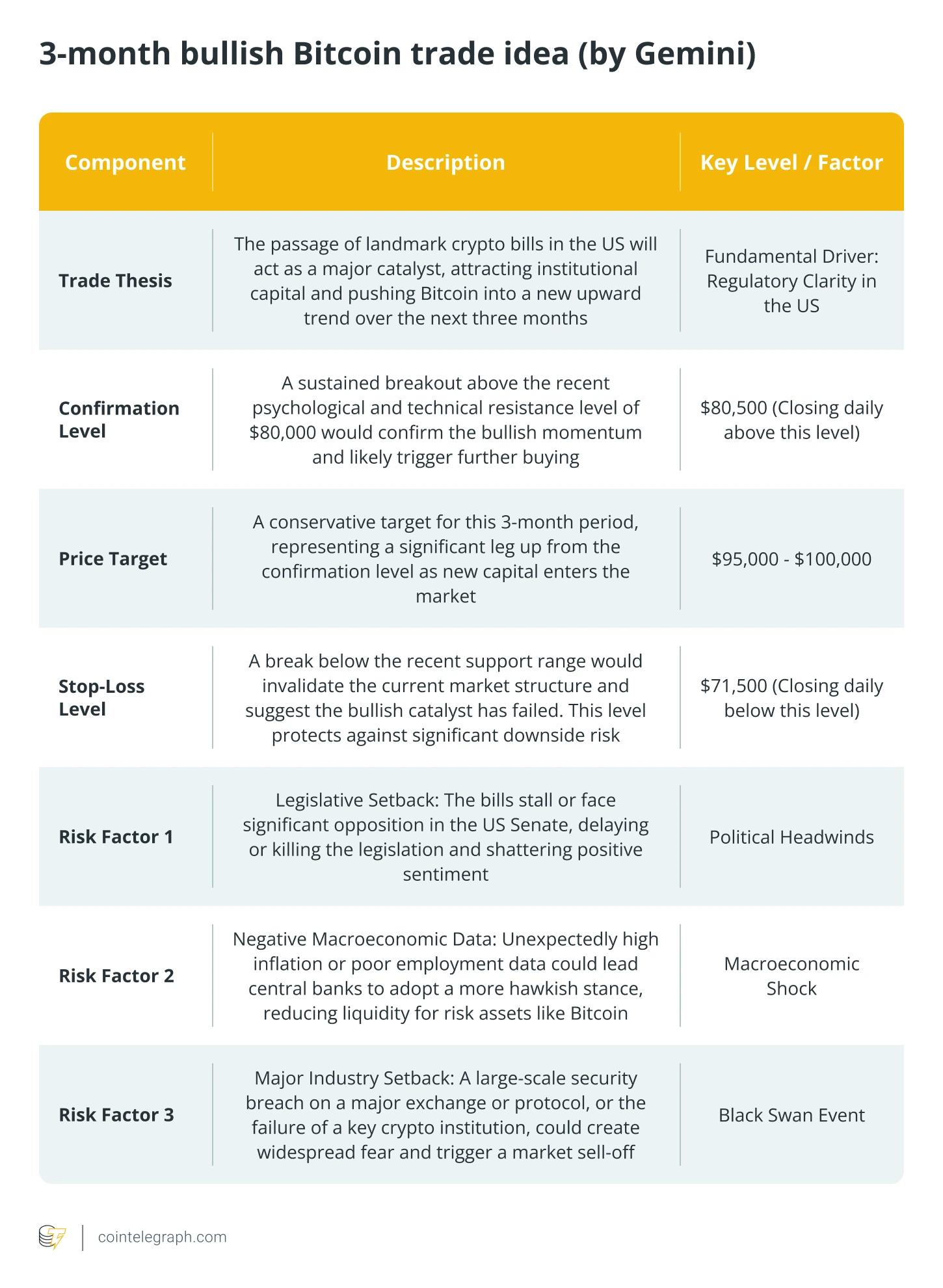

An Example Of A Bitcoin Trading Strategy Using Gemini

Source: Cointelegraph

It’s not about getting a magic buy/sell signal, it’s about AI-enhanced decision-making.

In crypto, different media outlets often deliver conflicting takes. While some hail new legislation as bullish for Bitcoin, others raise red flags for DeFi. This makes objective analysis difficult.

“Summarize the three crypto bills passed by the US House on July 17th, 2025, using sources from Bloomberg, Cointelegraph, and Wired. Limit the summary to 150 words.”

Gemini’s AI summary quickly pulls core insights from diverse, credible sources. Instead of reading three separate articles, you get one unified overview covering:

This saves time and offers balanced, cross-referenced reporting.

Crypto prices often react more to how investors feel about the news than the news itself. This emotional response is called market sentiment.

“Analyze how verified crypto influencers and financial media on X are reacting to the US crypto bills passed on July 17, 2025. What’s the overall sentiment?”

Google Gemini will parse through social media data from verified users and distill the tone: bullish, bearish, or neutral.

For example, Gemini might report:

This step helps gauge whether the market is poised for a short-term rally or pullback.

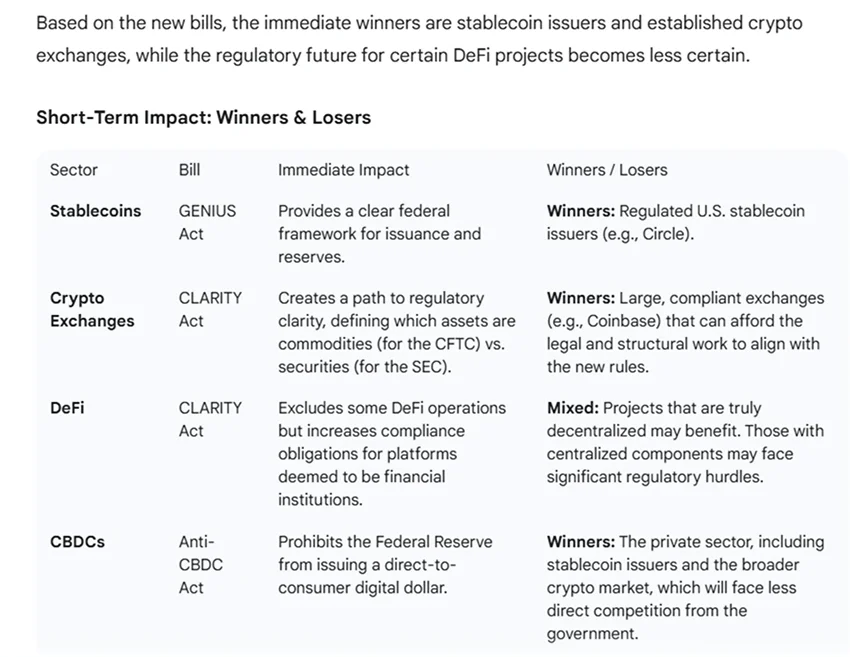

Once sentiment is clear, the next question is: Who benefits from this news and who doesn’t?

“Based on the new US crypto bills, which sectors or companies will benefit or face challenges? What could the longer-term impact be on crypto adoption and Bitcoin?”

Source: Gemini

Gemini’s response may include:

Google Gemini is a generative AI platform developed by Google, formerly known as Bard. It uses advanced large language models to assist with complex tasks like data analysis, writing, and summarizing information.

No, Gemini doesn’t give financial advice. However, it can help you analyze market news, identify trends, and structure potential trading ideas based on your inputs.

While both are large language models, Google Gemini is integrated with Google Search, YouTube, and other services, allowing it to pull in fresh, real-time data. It’s optimized for cross-source summarization and multimedia responses.

Gemini is a tool, not a financial advisor. It’s highly effective for research and structuring ideas, but you must always conduct your own due diligence and understand your risk profile before investing.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.39%

Figure Heloc(FIGR_HELOC)$1.04-0.39% USDS(USDS)$1.000.09%

USDS(USDS)$1.000.09% Hyperliquid(HYPE)$31.005.62%

Hyperliquid(HYPE)$31.005.62% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1639660.99%

Canton(CC)$0.1639660.99% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009948-1.03%

Rain(RAIN)$0.009948-1.03% World Liberty Financial(WLFI)$0.1067954.24%

World Liberty Financial(WLFI)$0.1067954.24% MemeCore(M)$1.470.38%

MemeCore(M)$1.470.38% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.06%

Falcon USD(USDF)$1.000.06% Aster(ASTER)$0.713.28%

Aster(ASTER)$0.713.28% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.73%

HTX DAO(HTX)$0.0000021.73%