Trump crypto regulation may take shape through a new executive order investigating alleged financial discrimination against crypto firms and conservatives.

The order instructs banking regulators to probe violations of consumer protection, antitrust, and fair lending laws.

Crypto leaders accuse the Biden administration of using regulatory pressure to force banks to cut ties with digital asset businesses.

The order will also examine claims of political debanking against conservative individuals and organizations.

If confirmed, this action could mark a significant policy reversal in how the federal government interacts with the crypto industry.

The draft executive order instructs regulatory agencies to examine whether U.S. banks have violated antitrust laws, consumer financial protection rules, or fair lending practices by cutting off services to crypto companies and politically conservative organizations.

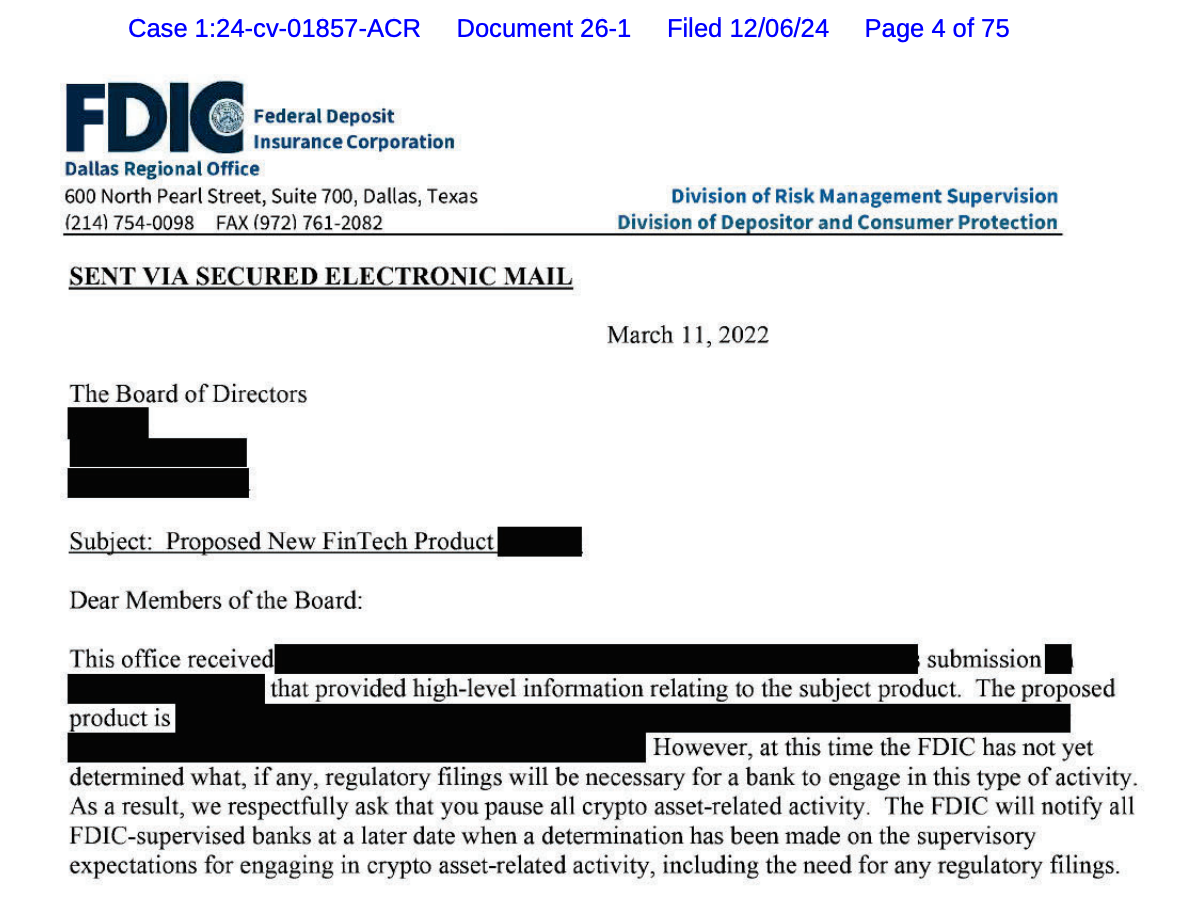

A Redacted FDIC Letter From 2022 To A Company Requesting It To Halt Its Crypto Activities

Source: FDIC

If violations are found, institutions could face fines or legal consequences. While the order could be signed this week, sources close to the matter caution that plans may change or be delayed.

Leaders in the crypto industry have long claimed that the Biden administration worked behind the scenes to pressure banks into distancing themselves from digital asset companies. These accusations intensified following the collapse of FTX in 2022, which was used by regulators as a justification to scrutinize crypto platforms more harshly.

Coinbase Chief Legal Officer Paul Grewal testified before Congress in early 2024, stating that the Federal Deposit Insurance Corporation (FDIC) had “bludgeoned banks” with excessive examinations concerning their crypto relationships. Grewal claimed banks were eventually worn down by the regulatory pressure.

Additionally, a Freedom of Information Act (FOIA) lawsuit supported by Coinbase revealed documents showing that the FDIC urged banks to halt crypto-related activities. Grewal argued this proved that the government’s actions were not just “some crypto conspiracy theory.”

Crypto VC Nic Carter dubbed the alleged targeting of crypto firms by banks as “Operation Choke Point 2.0”, drawing parallels with the Obama-era initiative that discouraged banks from working with certain “high-risk” industries, such as payday lenders.

A Summary Of The Original ‘Operation Chokepoint’ In 2013

Source: thehill.com

According to Carter and other industry voices, the Biden administration mirrored that effort by subtly coercing financial institutions to sever ties with the digital asset sector.

Trump’s forthcoming executive order seems to directly respond to these accusations, aiming to curb what he views as unfair banking discrimination and restore access to financial services for lawful crypto businesses.

The proposed Trump crypto regulation will reportedly instruct U.S. bank regulators to:

Investigate claims of financial discrimination against crypto firms and conservatives.

Refer findings of violations to the Department of Justice (DOJ) for legal follow-up.

Evaluate and repeal internal policies that may have encouraged debanking.

Direct the Small Business Administration (SBA) to review its loan guarantee policies for crypto-related businesses.

This broad probe may not name individual banks but will examine how institutions have aided or hindered political and crypto-related entities.

In addition to financial discrimination against crypto companies, Trump’s executive order also targets allegations of “political debanking.”

The order will investigate claims that financial institutions have denied services to conservative individuals or groups based on ideological grounds. While no specific banks are cited, the draft reportedly criticizes institutions that collaborated with federal investigations into the January 6th Capitol riots.

Banks typically justify such account closures through a practice known as “derisking”, which allows them to terminate relationships deemed reputationally risky. However, conservatives argue this policy has been abused for political reasons.

In a related development, the Federal Reserve announced in June that it will cease evaluating “reputational risk” as part of its bank supervision processes.

This follows similar decisions by the Office of the Comptroller of the Currency and the FDIC, signaling a broader pullback from subjective risk evaluations that critics claim were used to justify debanking.

The executive order reportedly planned by Donald Trump will direct federal bank regulators to investigate whether crypto firms and conservatives were unfairly denied banking services, possibly in violation of U.S. law.

The term refers to the alleged effort by regulators to cut off the crypto industry from the banking sector by pressuring financial institutions, echoing tactics used in a prior Obama-era initiative.

Conservatives claim they have been denied banking services for ideological reasons. The Trump administration wants to investigate if banks engaged in biased behavior that violates free speech or consumer rights.

If implemented, the order could ease access to banking services for crypto firms and potentially reverse restrictions imposed during the Biden era.

As of now, it is a draft order reported by The Wall Street Journal. Trump is expected to sign it soon, though plans may change.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.020.00%

Figure Heloc(FIGR_HELOC)$1.020.00% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Hyperliquid(HYPE)$29.81-4.01%

Hyperliquid(HYPE)$29.81-4.01% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.160002-0.31%

Canton(CC)$0.160002-0.31% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05% Rain(RAIN)$0.0098130.14%

Rain(RAIN)$0.0098130.14% World Liberty Financial(WLFI)$0.100735-5.87%

World Liberty Financial(WLFI)$0.100735-5.87% MemeCore(M)$1.29-0.17%

MemeCore(M)$1.29-0.17% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$188.18-0.17%

Bittensor(TAO)$188.18-0.17% Aster(ASTER)$0.72-0.76%

Aster(ASTER)$0.72-0.76% Falcon USD(USDF)$1.000.08%

Falcon USD(USDF)$1.000.08% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00%