A Bitcoin loophole can be a technical, market-based, or regulatory opportunity for profit.

Legitimate traders use these for arbitrage, buying Bitcoin low on one exchange and selling high on another.

Many scam platforms misuse the term “Bitcoin Loophole” to lure users into fake bots or Ponzi schemes.

Use only audited smart contracts, cold wallets, and multi-signature setups.

Regulatory compliance is essential, track your trades and stay informed on global rules like MiCA or FinCEN.

A Bitcoin loophole refers to any opportunity where a user can legally or technically exploit a gap in systems or rules for financial gain. These fall into two major categories:

Price inefficiencies (e.g. Bitcoin priced differently on Binance vs. Coinbase)

Software bugs in smart contracts

Manipulated oracles (used to feed incorrect price data)

Trading in countries with no crypto tax

Exploiting weaker KYC/AML laws

Structuring entities offshore to minimize reporting

These loopholes don’t always mean wrongdoing. Arbitrage trading is legal in most jurisdictions. However, using regulatory gaps to avoid taxes or hide assets can cross into legal gray areas, or worse.

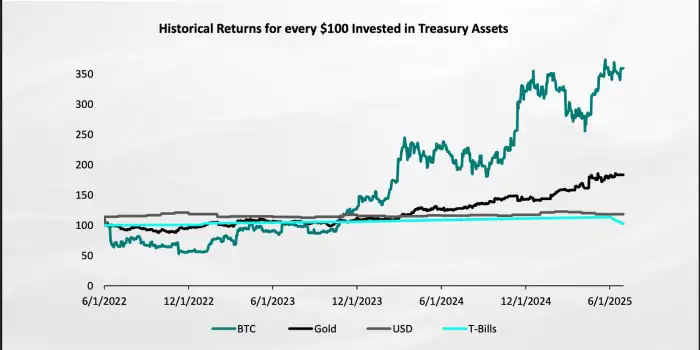

Bitcoin Beats Both Gold & T-bills On Returns & Tax Efficiency

Source: QCP

Arbitrage is the safest and most common form of exploiting a Bitcoin loophole. Here’s how pros do it:

Collect price feeds from multiple exchanges

Spot discrepancies (e.g. $50,000 on Binance vs. $50,100 on Coinbase)

Bots execute trades in milliseconds

Buy low → transfer funds → sell high

Profit from the spread, often 0.2–0.5% per trade

Use co-located servers near exchange data centers

Factor in trading fees, latency, and withdrawal time

Limit positions to avoid slippage and bot detection bans

When used wisely, this Bitcoin loophole strategy can deliver consistent micro-profits without risky leverage or exposure to dodgy platforms.

Unfortunately, the term “Bitcoin Loophole” is often co-opted by scams. Fake trading bots and platforms use the name to promise guaranteed daily returns, tricking users into handing over their funds.

Promises of 5–10% daily profits

No team info, no verifiable addresses

Glowing reviews with fake celebrity endorsements

Excuses for delayed withdrawals: “pending KYC,” “maintenance,” etc.

Users deposit money after slick marketing

The “bot” shows inflated account balances

Withdrawals are blocked, and support goes dark

Platform vanishes, funds lost

Even legitimate Bitcoin loophole strategies carry real risks. Key ones include:

Reentrancy attacks

Integer overflows/underflows

Poorly written withdrawal logic

Flash loan attacks can spoof price feeds

Use multi-source oracles like Chainlink

Hot wallets = easy access, higher risk

Cold wallets = secure, slower, but safer

Consider multi-signature wallets for shared access and extra protection

Global regulation is evolving fast. While some Bitcoin loopholes involve legitimate tax planning, others risk running afoul of the law.

Singapore: No capital gains tax on crypto

EU: MiCA regulation will increase compliance for token issuers

USA: FinCEN expanding AML reporting requirements

Report all trades unless local laws say otherwise

Use crypto tax tools like CoinTracker or Koinly

Keep CSV exports of trade history and wallet activity

A Bitcoin loophole is a situation, technical, market, or regulatory, that can be legally exploited for profit. Common examples include arbitrage trades or tax-optimized structures.

No. Arbitrage is legal, but exploiting tax reporting gaps or unlicensed platforms can get you into serious trouble.

Most platforms branded as Bitcoin Loophole bots are scams. Avoid any site promising guaranteed returns or showing fake testimonials.

Use hardware wallets, audited smart contracts, and avoid giving private keys or seed phrases to any platform.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.02%

Figure Heloc(FIGR_HELOC)$1.051.02% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$29.81-1.99%

Hyperliquid(HYPE)$29.81-1.99% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.1605220.41%

Canton(CC)$0.1605220.41% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% Rain(RAIN)$0.009389-1.97%

Rain(RAIN)$0.009389-1.97% World Liberty Financial(WLFI)$0.119033-3.90%

World Liberty Financial(WLFI)$0.119033-3.90% MemeCore(M)$1.350.30%

MemeCore(M)$1.350.30% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.02%

Falcon USD(USDF)$1.000.02% Aster(ASTER)$0.71-2.88%

Aster(ASTER)$0.71-2.88% Bittensor(TAO)$177.99-1.61%

Bittensor(TAO)$177.99-1.61% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00%