CZ and YZi Labs deny any current or future plans to raise external investor funds.

A Financial Times report claimed YZi Labs was preparing to open to outside capital and had drawn SEC interest.

Ella Zhang emphasized YZi Labs’ independence from Binance and denied any “private demos” with regulators.

The controversy reignites scrutiny over CZ’s ongoing influence and regulatory pressures in the crypto space.

YZi Labs manages a vast portfolio of 230+ crypto and Web3 projects.

On September 23rd, the Financial Times published a report alleging that YZi Labs, a venture capital fund managing Zhao’s personal fortune and capital from early Binance insiders, was courting external investors.

The report also suggested that the U.S. Securities and Exchange Commission (SEC) had shown interest in the fund’s portfolio, requesting a private demo of its startup holdings.

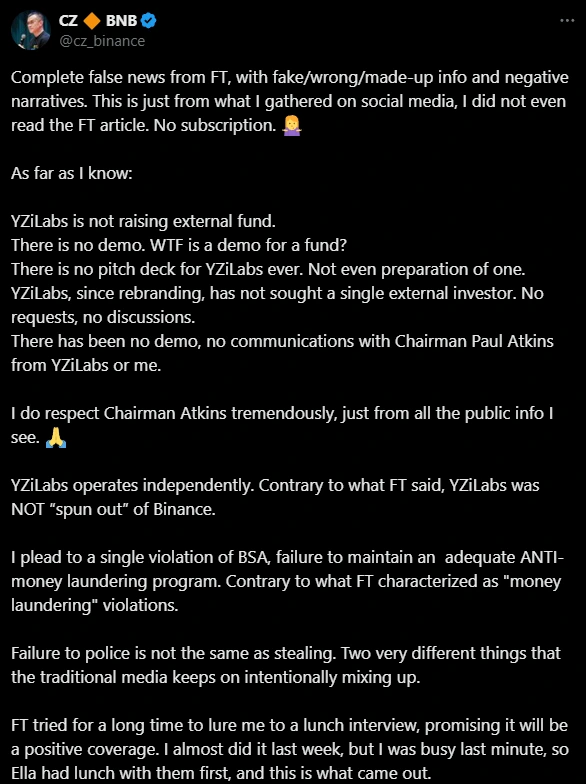

However, CZ took to social media shortly after the article went live, stating that the entire ordeal was false.

Source: X (@cz_binance)

His statement quickly gained traction across crypto Twitter, reigniting ongoing debates about transparency and the blurred lines between crypto investment vehicles and regulatory oversight.

The FT article claimed that YZi Labs had once accepted $300 million in outside capital back in 2022 but later returned a portion of it due to the fund’s already substantial assets under management.

The piece quoted Ella Zhang, the head of YZi Labs, who reportedly stated:

“There’s always a lot of external investors interested. We will eventually consider turning it into an external-facing fund. We just think it’s not there yet.”

The report also noted that the SEC, under Chair Paul Atkins, had recently shown increased openness toward crypto ventures and even requested a private demo after missing YZi Labs’ event at the New York Stock Exchange.

Ella Zhang also took to social media to clarify the situation, denying any intentions to raise limited partner (LP) capital.

She emphasized that YZi Labs:

Operates independently from Binance

Was rebranded from Binance Labs but was not spun off

Hosted a public-facing demo event, not a private SEC meeting

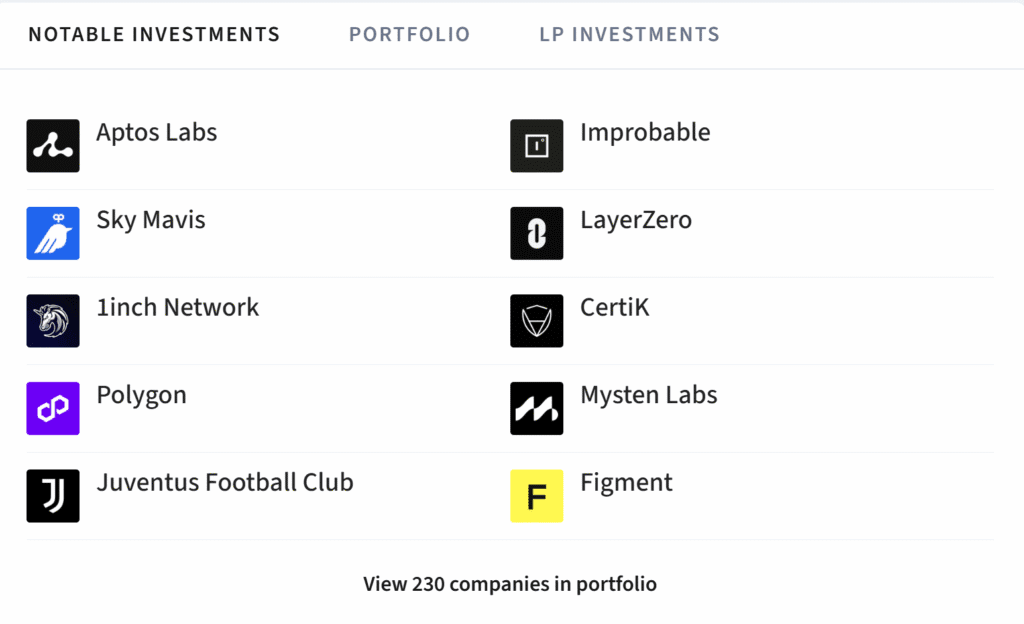

Despite the controversy, YZi Labs continues to be a major player in the blockchain and Web3 space. Its portfolio boasts over 230 companies, including high-profile names like:

Aptos Labs

Polygon

Sky Mavis

1inch Network

CertiK

LayerZero

Mysten Labs

Source: Dealroom

This expansive portfolio has drawn significant attention from both the venture capital world and regulators, hence the heightened scrutiny.

The YZi Labs controversy also brings CZ’s legal past into sharper focus. He stepped down as CEO of Binance after pleading guilty to failing to implement anti-money laundering (AML) controls, serving a four-month prison sentence.

He is currently seeking a pardon from U.S. President Donald Trump and remains Binance’s largest shareholder.

YZi Labs isn’t the only crypto-native venture fund in the spotlight. In June, Galaxy Digital closed its first external fund with $175 million, surpassing its $150 million goal.

The demand for early-stage blockchain infrastructure investments remains strong, especially among institutional players seeking outsized returns.

Bitcoin analyst Willy Woo even stated he had sold most of his Bitcoin holdings, arguing that early-stage crypto startups offered better return potential, citing 100x to 1,000x possibilities.

The YZi Labs controversy refers to conflicting reports about whether CZ’s $10B fund, YZi Labs, is planning to accept outside investment. While the Financial Times suggested the fund was opening up, CZ and YZi Labs leadership have publicly denied it.

YZi Labs is a personal investment fund owned by Changpeng Zhao (CZ) and managed independently from Binance. It was formerly known as Binance Labs before rebranding.

No. Both CZ and Ella Zhang deny any private meetings or demos with the Securities and Exchange Commission. All recent demo events were reportedly public.

Given its size, influence, and CZ’s legal history, YZi Labs is under increased regulatory scrutiny. The fund also manages a vast portfolio of crypto startups, making it a key player in the industry.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.57%

Figure Heloc(FIGR_HELOC)$1.03-0.57% Wrapped stETH(WSTETH)$3,681.310.99%

Wrapped stETH(WSTETH)$3,681.310.99% Wrapped eETH(WEETH)$3,265.461.00%

Wrapped eETH(WEETH)$3,265.461.00% USDS(USDS)$1.000.28%

USDS(USDS)$1.000.28% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04% Hyperliquid(HYPE)$33.1515.16%

Hyperliquid(HYPE)$33.1515.16% Coinbase Wrapped BTC(CBBTC)$89,325.001.38%

Coinbase Wrapped BTC(CBBTC)$89,325.001.38% WETH(WETH)$3,004.441.25%

WETH(WETH)$3,004.441.25% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.16947411.00%

Canton(CC)$0.16947411.00% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% World Liberty Financial(WLFI)$0.1640664.11%

World Liberty Financial(WLFI)$0.1640664.11% USDT0(USDT0)$1.000.11%

USDT0(USDT0)$1.000.11% sUSDS(SUSDS)$1.08-0.05%

sUSDS(SUSDS)$1.08-0.05% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.009956-1.18%

Rain(RAIN)$0.009956-1.18% MemeCore(M)$1.53-2.31%

MemeCore(M)$1.53-2.31%