AI Agents could become Ethereum’s largest transaction drivers, enabled by standards like HTTP 402 and EIP-3009.

Developers are already testing autonomous payment loops, especially for compute and content-generation services.

Ethereum’s scalability challenges are being met by Layer-2 solutions such as Optimism and Arbitrum.

Regulatory uncertainty and lack of global standards could delay mainstream adoption of AI-driven transactions.

If widely adopted, AI agents could add $500 million in annual fees to Ethereum by 2030.

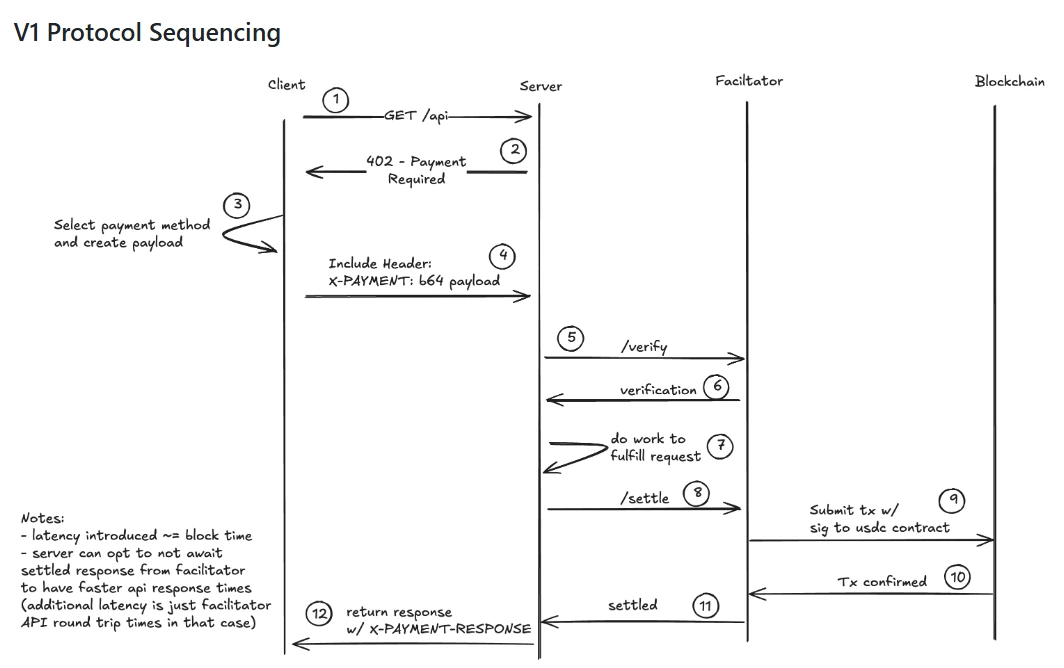

The HTTP 402 status code, originally reserved but unused, is being repurposed as a mechanism to require programmatic payments for digital services.

Notably, this also includes API access, cloud storage, and other computational resources.

Source: X (@ethereum)

EIP-3009 builds on this by allowing off-chain ERC-20 token approvals, enabling gasless and programmable token transfers. Leffew likens it to a vending machine, insert payment, and access is granted instantly.

Pioneers like Hyperbolic Labs are already putting theory into practice. They’re enabling their large language models to autonomously pay for compute resources using Ethereum and the HTTP 402 protocol, creating closed-loop economic systems.

Prodia Labs is also implementing AI-driven payments for media generation. Their AI agents render and pay for content creation tasks automatically, improving efficiency in creative workflows.

The possibilities are vast:

Self-driving vehicles paying tolls or charging fees

AI content models purchasing API access to enhance outputs

Decentralized infrastructure where machines pay machines

These use cases rely on Ethereum’s trustless settlement layer and programmable transaction logic, ideal for the high-frequency, low-value transactions AI agents require.

Despite the excitement, Ethereum’s base layer still processes only 15–20 transactions per second (TPS), raising questions about scalability for billions of microtransactions.

Solutions like Arbitrum and Optimism are filling the gap. Combined, these Layer-2 rollups processed over 10 million transactions in July 2025:

Arbitrum: 46 million transactions in one month

Optimism: 661.9 million total as of August 2025

These platforms enable near-instant, low-cost settlement, perfect for AI-driven systems.

To address this, Coinbase developers are collaborating across the Ethereum ecosystem to standardize HTTP 402 and EIP-3009. This aims to ensure secure and seamless interoperability among AI agents, blockchains, and real-world services.

Diagram Of The V1 Protocol Sequencing

Source: GitHub

Autonomous AI agents performing financial actions fall into a gray area legally. Although the U.S. GENIUS Act helps define stablecoin frameworks, it does not fully address AI-powered payment systems.

AI Agents are autonomous programs capable of making decisions and performing blockchain transactions without human oversight.

It allows AI agents to make programmatic payments for services like APIs and cloud storage—unlocking new decentralized business models.

EIP-3009 enables secure, gasless token transfers on Ethereum, which is essential for microtransactions and automation.

Not alone. Ethereum’s base layer is limited, but Layer-2 rollups like Arbitrum and Optimism provide the throughput and cost-efficiency needed.

Yes. Regulatory clarity around AI-driven financial systems is still lacking, and current laws don’t fully accommodate non-human actors making payments.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.41%

Figure Heloc(FIGR_HELOC)$1.040.41% Wrapped stETH(WSTETH)$3,696.073.61%

Wrapped stETH(WSTETH)$3,696.073.61% Wrapped eETH(WEETH)$3,276.933.69%

Wrapped eETH(WEETH)$3,276.933.69% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.02%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.02% Hyperliquid(HYPE)$34.2324.30%

Hyperliquid(HYPE)$34.2324.30% Coinbase Wrapped BTC(CBBTC)$89,290.001.73%

Coinbase Wrapped BTC(CBBTC)$89,290.001.73% WETH(WETH)$3,016.713.77%

WETH(WETH)$3,016.713.77% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.17020215.25%

Canton(CC)$0.17020215.25% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% World Liberty Financial(WLFI)$0.1644534.84%

World Liberty Financial(WLFI)$0.1644534.84% USDT0(USDT0)$1.00-0.03%

USDT0(USDT0)$1.00-0.03% sUSDS(SUSDS)$1.08-0.27%

sUSDS(SUSDS)$1.08-0.27% Ethena Staked USDe(SUSDE)$1.22-0.06%

Ethena Staked USDe(SUSDE)$1.22-0.06% Rain(RAIN)$0.009828-2.64%

Rain(RAIN)$0.009828-2.64% MemeCore(M)$1.54-0.62%

MemeCore(M)$1.54-0.62%