Joe Lubin predicts ETH could 100x due to rising institutional adoption of decentralized rails.

Ethereum may flip Bitcoin as the dominant monetary base, according to Lubin and Tom Lee.

Financial institutions are actively exploring staking, DeFi, and smart contract platforms built on Ethereum.

Stablecoin supply on Ethereum has exceeded $160 billion, highlighting strong demand.

ETH faces short-term price resistance but has long-term momentum fueled by infrastructure and use-case growth.

In a recent post on X, Lubin asserted that major financial institutions are preparing to stake ETH and adopt Ethereum-based systems.

Source: X (@ethereumJoseph)

He believes Ethereum’s architecture will replace siloed, expensive infrastructure currently used by traditional finance (TradFi).

According to him, the convergence of institutional finance with Ethereum’s decentralized rails will drive enormous demand for ETH.

Financial institutions will no longer just passively invest in crypto, they’ll actively stake, run validators, deploy smart contracts, and build on Layer-2 networks.

Lubin echoed sentiments from Tom Lee, managing partner at Fundstrat Global Advisors, who believes Ethereum could flip Bitcoin in terms of network utility and value.

Lubin declared:

“Yes, Ethereum/ETH will flip the Bitcoin/BTC monetary base.”

While Bitcoin currently holds a larger market capitalization, Ethereum’s increased adoption and utility are closing the gap.

According to TradingView, ETH’s market dominance has grown significantly, now sitting at 14.3%, double what it was in April.

Lubin compared Ether to a new kind of digital commodity:

“Trust is a new kind of virtual commodity. And ETH, the highest octane decentralized trust commodity, will eventually flippen all the other commodities on the planet.”

Ethereum’s programmability and its support for hybrid human-machine intelligence make it not just a currency, but the backbone of a decentralized economy.

Nassar Achkar, Chief Strategy Officer at CoinW, highlighted that Lubin’s forecast is already resonating with institutional investors:

“Institutional clients are increasingly allocating treasury assets to ETH due to its staking yield potential and role in tokenization ecosystems.”

Achkar added that Ethereum’s decentralized rails are transforming ETH into a productive asset and a core component of future global finance.

Ethereum isn’t just gaining traction in staking and DeFi. It’s also becoming the go-to network for stablecoins.

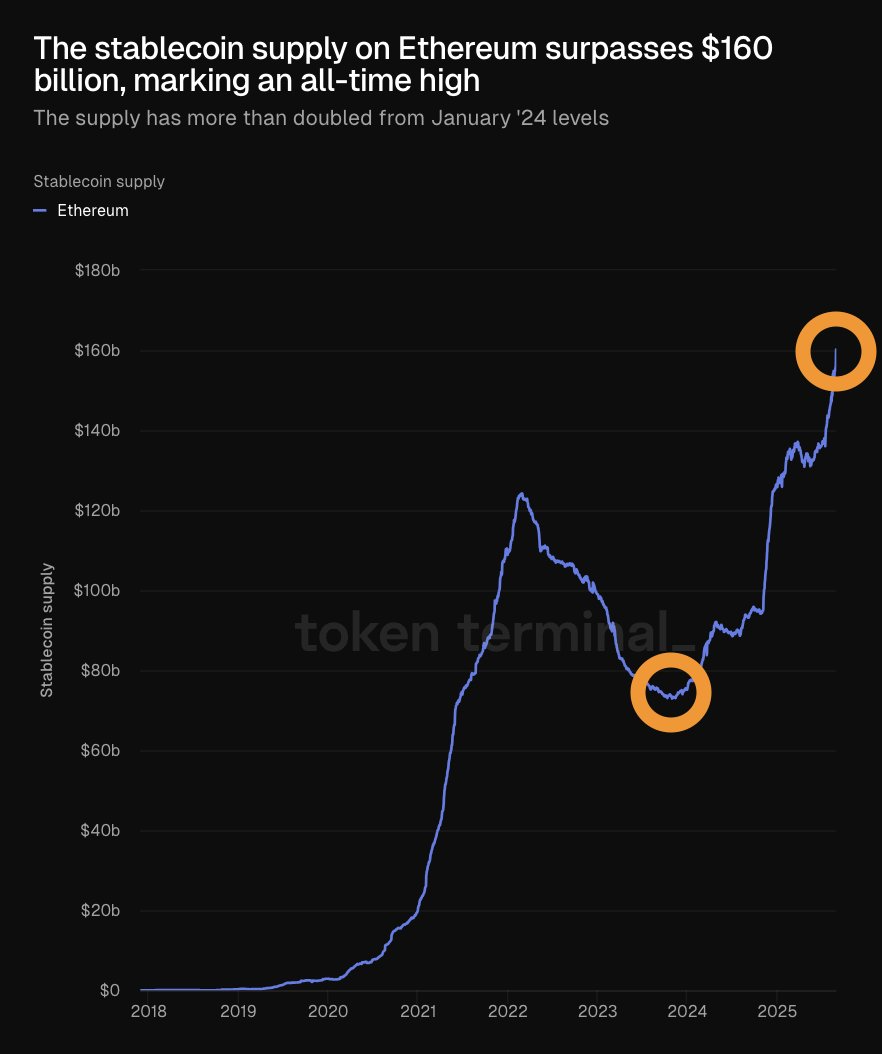

According to Token Terminal, stablecoin supply on Ethereum hit an all-time high, surpassing $160 billion, more than doubling since January 2024.

Tom Lee noted that this growth is another strong signal of Ethereum’s growing importance:

“Stablecoin demand seems exponential on Ethereum.”

Stablecoin Supply On Ethereum Has Skyrocketed

Source: Token Terminal

Despite the bullish narrative, ETH faced resistance near the $4,500 level over the weekend, dipping back below $4,400 during early Monday trading.

Still, many analysts view this as short-term volatility in an otherwise upward trajectory, especially given the long-term potential of decentralized rails and institutional adoption.

Decentralized rails refer to blockchain-based infrastructure, like Ethereum, that allows for transparent, trustless, and programmable financial services without centralized intermediaries.

Ethereum supports staking, smart contracts, stablecoin transfers, and tokenization, making it a versatile platform for institutional-grade finance and on-chain asset management.

While it’s a bold claim, the increasing utility, yield opportunities, and adoption of Ethereum make the “flippening” a real possibility, especially if Wall Street continues to build on decentralized rails.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.10%

Figure Heloc(FIGR_HELOC)$1.031.10% Wrapped stETH(WSTETH)$3,565.410.72%

Wrapped stETH(WSTETH)$3,565.410.72% Wrapped eETH(WEETH)$3,161.960.73%

Wrapped eETH(WEETH)$3,161.960.73% USDS(USDS)$1.00-0.24%

USDS(USDS)$1.00-0.24% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Coinbase Wrapped BTC(CBBTC)$87,920.000.19%

Coinbase Wrapped BTC(CBBTC)$87,920.000.19% WETH(WETH)$2,909.960.76%

WETH(WETH)$2,909.960.76% Ethena USDe(USDE)$1.000.06%

Ethena USDe(USDE)$1.000.06% Hyperliquid(HYPE)$27.4923.12%

Hyperliquid(HYPE)$27.4923.12% Canton(CC)$0.1523592.28%

Canton(CC)$0.1523592.28% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% World Liberty Financial(WLFI)$0.157099-2.77%

World Liberty Financial(WLFI)$0.157099-2.77% sUSDS(SUSDS)$1.080.16%

sUSDS(SUSDS)$1.080.16% Ethena Staked USDe(SUSDE)$1.220.04%

Ethena Staked USDe(SUSDE)$1.220.04% Rain(RAIN)$0.0101355.60%

Rain(RAIN)$0.0101355.60% MemeCore(M)$1.56-3.44%

MemeCore(M)$1.56-3.44%