Sunk-cost-maxxing is the crypto industry’s habit of pivoting too quickly, undermining long-term innovation.

Product cycles have shrunk to 18 months or less, making meaningful infrastructure almost impossible to build.

Venture capital incentives and short-term token economics reinforce the problem.

Sustainable crypto projects require multi-year commitment, long vesting schedules, and user incentives that go beyond hype.

Breaking this cycle could separate the next generation of builders from those chasing the next pump.

Sargsian recently posted an article on X titled “Why Crypto Can’t Build Anything Long-Term.”

In it, she argues that founders in the crypto space have developed “paper hands”, constantly pivoting to whatever new narrative can attract short-term attention and fresh investor capital.

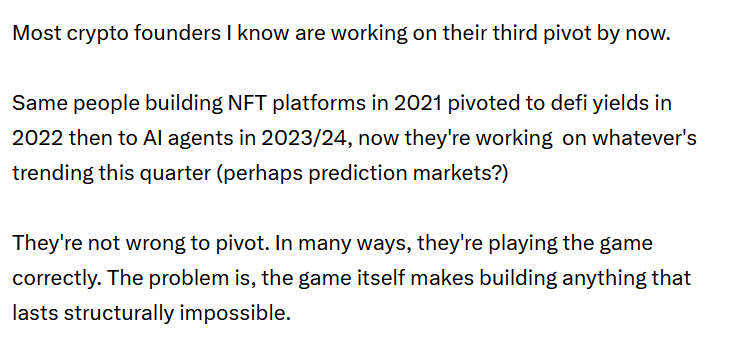

She wrote:

“Traditional business advice says: don’t fall for the sunk cost fallacy, if something isn’t working, pivot. Crypto took that idea and turned it into sunk-cost-maxxing.”

According to Sargsian, the mindset has become so ingrained that the moment a project faces slow growth, investor pressure, or resistance, the default response is to pivot.

Source: Rosie Sargsian

Clearly, what began as healthy adaptability has transformed into compulsive short-termism.

Sargsian describes a compressed 18-month product cycle now dominating the industry. A new narrative emerges, whether it’s DeFi, NFTs, or AI-integrated blockchains, and venture funding floods in.

Within six to nine months, hype peaks. Then interest fades, investors move on, and founders feel pressured to chase the next big thing rather than double down on the current one.

She stresses that the fault doesn’t necessarily lie with founders themselves. They’re “playing the game correctly,” she says, but the game itself is broken.

In traditional tech, real infrastructure and product-market fit take years. Companies like Amazon and Google didn’t become household names overnight. They evolved over 5–10 years through iteration and persistence.

Crypto, however, operates on a quarterly trend calendar. Founders who continue developing last year’s narrative are seen as “dead money.” Investors ghost them. Users drift away. Some venture capital firms even pressure teams to pivot toward the latest buzzword sector.

Sargsian wrote:

“You can’t build anything meaningful in 18 months. Real products take time. But if you’re not building what’s trendy, your investors and users will leave before you even get the chance.”

The challenge isn’t just market pressure, it’s also how projects incentivize participation. Token launches, airdrops, and gamified reward systems attract short-term users but often fail to retain them once rewards dry up.

Projects like NFT platforms experienced this firsthand. Rapid token speculation inflated early engagement, but once prices fell, so did participation. The result? Empty ecosystems and fleeting brand loyalty.

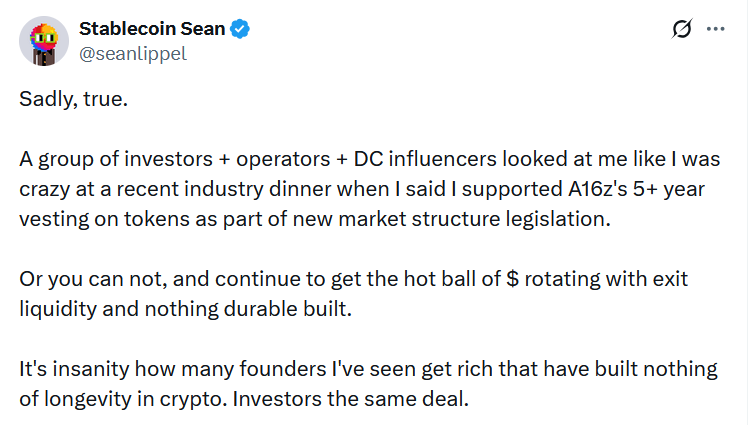

Responding to Sargsian’s post, Sean Lippel, general partner at FinTech Collective, echoed her concerns, suggesting that some investors prefer short-term thinking.

Source: X (@seanlippel)

The implication? Sunk-cost-maxxing benefits the wrong people, rewarding early cash-outs while discouraging persistence and craftsmanship.

Breaking the cycle of sunk-cost-maxxing requires changing the incentive structures that reward hype over durability. Founders, investors, and users alike must recalibrate expectations around time horizons, vesting periods, and real adoption metrics.

The projects that endure will likely be the ones that embrace long-term patience — even when that means resisting the gravitational pull of the next trend.

It’s a play on the “sunk cost fallacy.” In crypto, it refers to the opposite extreme — abandoning projects too early and constantly pivoting to chase hype, instead of building through tough phases.

It destroys long-term focus. Projects never mature beyond MVP stage, investors lose trust, and the ecosystem remains stuck in speculative cycles.

By implementing longer vesting schedules, setting realistic growth timelines, and measuring progress by user retention and infrastructure stability — not just token price.

Not necessarily. Strategic pivots can save startups, but constant pivoting for hype’s sake dilutes innovation and weakens credibility.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.000.03%

Figure Heloc(FIGR_HELOC)$1.000.03% Wrapped stETH(WSTETH)$3,888.303.68%

Wrapped stETH(WSTETH)$3,888.303.68% USDS(USDS)$1.00-0.03%

USDS(USDS)$1.00-0.03% Hyperliquid(HYPE)$34.891.19%

Hyperliquid(HYPE)$34.891.19% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% WETH(WETH)$3,185.823.74%

WETH(WETH)$3,185.823.74% Wrapped eETH(WEETH)$3,448.693.67%

Wrapped eETH(WEETH)$3,448.693.67% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Coinbase Wrapped BTC(CBBTC)$93,101.00-0.67%

Coinbase Wrapped BTC(CBBTC)$93,101.00-0.67% World Liberty Financial(WLFI)$0.160324-0.87%

World Liberty Financial(WLFI)$0.160324-0.87% sUSDS(SUSDS)$1.08-0.14%

sUSDS(SUSDS)$1.08-0.14% USDT0(USDT0)$1.00-0.05%

USDT0(USDT0)$1.00-0.05% Ethena Staked USDe(SUSDE)$1.21-0.01%

Ethena Staked USDe(SUSDE)$1.21-0.01% Bittensor(TAO)$298.433.87%

Bittensor(TAO)$298.433.87% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% Canton(CC)$0.074746-1.94%

Canton(CC)$0.074746-1.94%