The global TradFi market, valued at over $400 trillion, presents a massive opportunity for RWA tokenization.

Tokenized RWAs have reached an all-time high of $26.5 billion, growing 70% in 2025 alone.

Ethereum dominates but faces increasing competition from other chains in a multichain future.

Private credit and U.S. Treasurys currently make up the majority of tokenized assets.

Platforms like Chainlink and tokens like ETH are seeing increased demand due to the growth of RWAs.

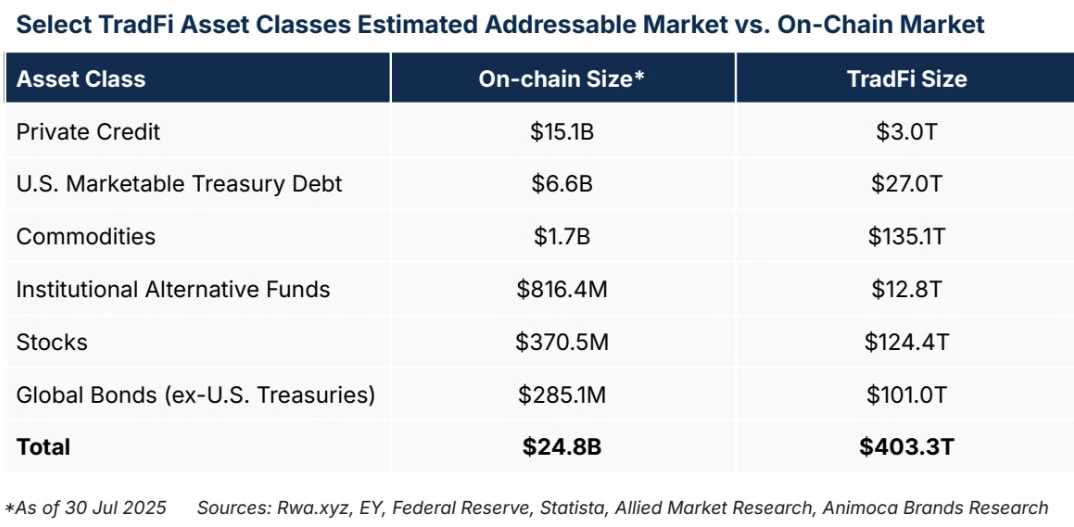

In a research paper released last month, Andrew Ho and Ming Ruan from Animoca Brands emphasized the immense potential of the TradFi market for RWA tokenization.

The researchers said:

“The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization”

Currently, the on-chain RWA market is valued at $26.5 billion, a small fraction of the total potential. That represents just 0.0066% of the global TradFi asset base.

Tokenization is beginning to make its way into a wide array of financial instruments, as seen below:

The TradFi Addressable Asset Market Is 16K Times Bigger Than The Current On-chain Market

Source: Animoca Brands

Animoca’s researchers noted a “strategic race” among major asset managers to build end-to-end platforms that can oversee the full lifecycle of these assets, from issuance to settlement, on blockchain infrastructure.

Ethereum currently holds the lion’s share of RWA tokenization activity, accounting for:

55% of the total tokenized value, including stablecoins

$156 billion in on-chain value

76% market share when including Ethereum Layer-2s like Polygon, Arbitrum, and ZKsync Era

Ethereum’s dominance is largely due to:

Proven security

Deep liquidity

A mature ecosystem of developers and DeFi applications

However, the Animoca report stresses that the RWA future is inherently multichain. Competing high-performance and specialized networks are entering the space, suggesting interoperability will be crucial moving forward.

The authors noted:

“RWA tokenization is unfolding across a multichain ecosystem encompassing public and private blockchains.”

Animoca itself launched NUVA, its own tokenized RWA marketplace, earlier this month, highlighting its active role in shaping the future of tokenized finance.

The expansion of tokenized RWAs in the TradFi market is also influencing crypto prices. The rising demand for RWA platforms and infrastructure is boosting tokens like:

Ether (ETH) – recently hitting an all-time high

Chainlink (LINK) – a key oracle provider enabling data feeds for tokenized assets

These assets may serve as the backbone for further TradFi integration as real-world and digital markets continue to converge.

According to data from RWA.xyz, the tokenized RWA market has grown 70% since the beginning of the year, now reaching an all-time high of $26.5 billion.

This growth reflects increasing institutional confidence and signals that RWAs are becoming a core component of the evolving blockchain economy.

Source: RWA.xyz

Two sectors dominate the current tokenized RWA landscape:

Private Credit

Together, they account for nearly 90% of the market’s total value. As more institutional products get tokenized, this diversification is expected to expand into other asset classes.

Real-world assets (RWAs) refer to traditional financial instruments—such as bonds, real estate, or credit—that are tokenized and represented on blockchain networks.

The TradFi market represents over $400 trillion in assets. Even small-scale tokenization of this market could unlock trillions in on-chain value.

Currently, Ethereum leads, but platforms like Polygon, Arbitrum, and newer high-performance chains are quickly gaining ground.

Faster settlement times

Increased liquidity

Greater transparency

Global accessibility to financial instruments

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.38%

Figure Heloc(FIGR_HELOC)$1.04-0.38% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$31.948.73%

Hyperliquid(HYPE)$31.948.73% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.1623640.24%

Canton(CC)$0.1623640.24% USD1(USD1)$1.00-0.06%

USD1(USD1)$1.00-0.06% Rain(RAIN)$0.0101123.47%

Rain(RAIN)$0.0101123.47% World Liberty Financial(WLFI)$0.1060700.73%

World Liberty Financial(WLFI)$0.1060700.73% MemeCore(M)$1.37-4.31%

MemeCore(M)$1.37-4.31% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.743.97%

Aster(ASTER)$0.743.97% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Sky(SKY)$0.0700256.94%

Sky(SKY)$0.0700256.94% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02%