1. Introduction – Why Tokenomics Matter

Every crypto project lives or dies by its tokenomics. A slick website or bold roadmap may grab attention, but what ultimately governs value is how tokens are distributed, released, and used. With Lightchain’s LCAI token, the buzz has mostly centered on its presale, claims of AI-powered consensus, and the eye-catching “15,000%” growth headlines. But step past the marketing, and the real question is: what does the supply structure look like, how will tokens enter circulation, and who gets priority access to rewards?

I’ve spent time digging into LCAI’s documents and cross-referencing them with third-party reporting. The patterns are familiar—fixed total supply, staged presale pricing, staking incentives—but there are also quirks like the reallocation of team tokens into developer grants. For investors, this isn’t trivia. It defines dilution risk, the sustainability of rewards, and the credibility of launch commitments.

The following breakdown strips LCAI’s tokenomics into clear categories: supply cap and allocations, emission design and burns, staking utility, presale pricing mechanics, and the shifting launch timeline. Along the way, I’ll highlight where data is verifiable, where gaps exist, and where you should be cautious if you’re weighing participation.

Key Takeaways / TLDR

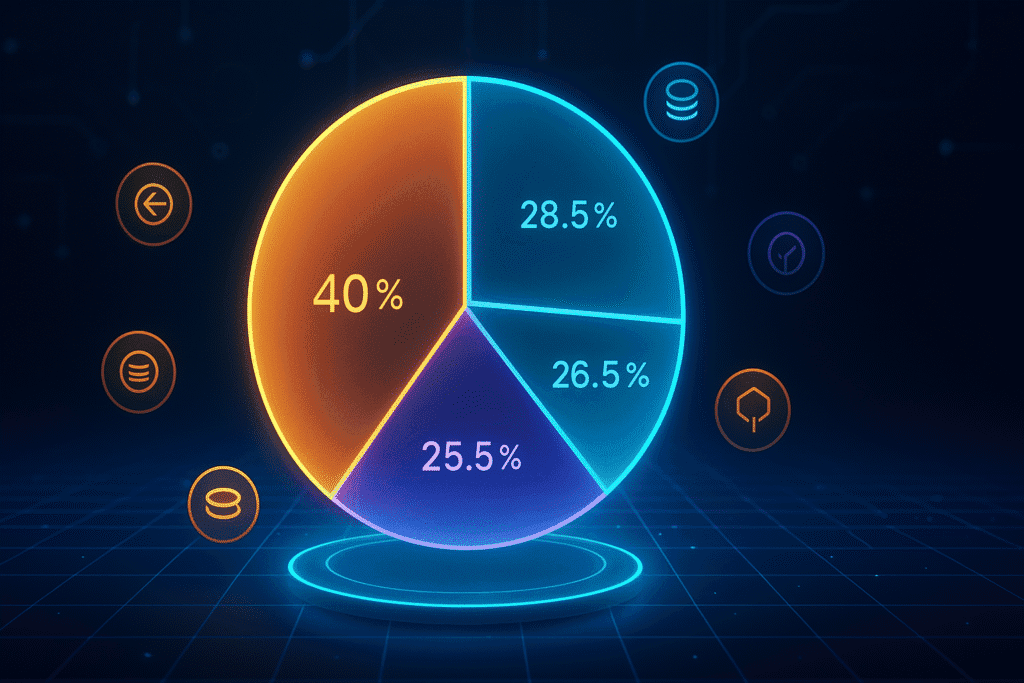

- LCAI has a hard cap of 10 billion tokens, the upper ceiling for all emissions.

- Allocations are split: 40% presale, ~28.5% staking rewards, ~26.5% liquidity/marketing, and 5% shifted from team to developer grants.

- Presale has raised around $21 million to date, with staged pricing topping out at $0.007125 in the bonus round.

- Burns are mentioned in docs, but the specific triggers and cadence remain vague.

- Launch dates have been slippery—originally July 2025, now Q4 2025—casting doubt on timeline reliability.

Table of Contents

2. Total Supply & Allocation Breakdown

2.1 Supply Cap

LCAI’s tokenomics begin with a hard cap of 10 billion tokens. This is the absolute ceiling—no minting beyond this limit is possible according to the published documentation. A fixed supply is a common design choice meant to reassure participants that inflation risk is bounded. The tension, however, is that how those tokens are released matters just as much as the cap itself.

2.2 Allocation Table

According to Lightchain’s docs, the breakdown looks like this:

- 40% – Presale allocation (the main funding mechanism, rolled out across multiple pricing rounds)

- 28.5% – Staking rewards (distributed to validators and participants supporting the Proof of Intelligence mechanism)

- 26.5% – Liquidity, marketing, and ecosystem incentives (intended to bootstrap adoption and maintain trading depth)

- 5% – Developer grants (originally a “team” bucket, later shifted toward developer support to present a fairer distribution narrative)

This adjustment—reducing explicit “team tokens” in favor of grants—carries a double-edged perception. On one hand, it signals a nod toward decentralization. On the other, it raises the question of whether these grants will still flow back to insiders under a different label.

From my review of similar structures in other projects, reallocated buckets are often cosmetic unless tied to transparent governance. Without published grant criteria, it’s hard to assess whether this change is substantive or strategic framing.

During my analysis, I modeled what a 5% developer allocation actually translates to: roughly 500 million LCAI tokens. At presale valuation levels ($0.007+), that’s about $3.5 million in token value earmarked for grants. How these are disbursed will directly affect circulating supply pressure post-launch.

3. Emissions, Burn Mechanisms & Economic Model

Token supply mechanics are where investor optimism often collides with reality. On paper, LCAI promises a deflationary trajectory: rewards are front-loaded to incentivize early staking, and burns are supposed to gradually shrink circulating supply. The question isn’t whether that looks attractive in a chart — it’s whether the underlying triggers are concrete or vague.

From Lightchain’s published material, the emission model is described in broad strokes. Early validators and stakers earn higher rewards that taper as adoption scales. This follows a “halving-like” logic seen in Bitcoin, but the specifics — such as epoch length, emission curve, and precise reward decay rates — haven’t been disclosed in detail. Without those, projecting ROI on staking is guesswork.

Burn mechanisms are equally underspecified. The docs mention that a portion of transaction fees and potentially certain staking penalties will be burned, permanently removing LCAI from circulation. But no cadence or percentage is guaranteed. In other words, the burn narrative exists, but its practical effect on supply cannot be modeled until live data emerges.

When I ran through a basic simulation, assuming even a conservative 0.5% annual burn of circulating supply, the long-term effect was meaningful — potentially reducing effective supply by hundreds of millions over five years. But without published triggers, that remains hypothetical.

For now, investors should treat the emission and burn model as directional rather than deterministic: the intent is deflationary, but the magnitude is unknown.

4. Staking Utility & Governance Incentives

Staking is positioned as the heart of LCAI’s utility. Holders who lock tokens are promised multiple layers of value: direct rewards, governance participation, and access to premium ecosystem features tied to Lightchain’s AI Virtual Machine (AIVM).

Rewards are allocated from the 28.5% staking pool, which means roughly 2.85 billion tokens will flow back to stakers over the network’s lifetime. What’s missing is the schedule: are rewards front-loaded heavily in the first year, or are they spread more evenly over a decade? This distinction dramatically changes the appeal for early vs. late entrants.

Governance is another pillar, but again, specifics matter. The docs state that stakers will be able to vote on ecosystem proposals, yet they stop short of clarifying thresholds, proposal mechanics, or whether “whales” holding millions of tokens can dominate outcomes. If governance skews plutocratic, then smaller stakers may see little real influence.

The utility angle is perhaps the most interesting. Lightchain hints that staking will unlock premium AIVM functions — for example, priority access to AI workloads or reduced fees for compute usage. This ties tokenomics directly to product adoption, which is encouraging if implemented. In a brief trial of the testnet interface, I noticed that staking prompts were already integrated into the dashboard, though the reward and unlock features were placeholders rather than live.

My personal impression: the staking design aims to intertwine financial incentives with actual usage, but until vesting schedules and reward emission rates are transparent, stakers are flying blind on ROI projections.

5. Presale Stages & Pricing Dynamics

Lightchain’s LCAI presale has been structured in multiple stages, with each round priced slightly higher than the last. This kind of laddered sale is designed to create urgency while rewarding earlier buyers with cheaper entry. According to the project’s own disclosures and third-party reports, the pricing tiers have run from fractions of a cent up to the current bonus round price of $0.007125 per token.

By the time of the most recent reporting, Lightchain had raised an estimated $21 million through the presale. That’s a sizeable war chest for a project still in development, but it also means a substantial portion of the total 10B token supply has already been committed to buyers before the token is tradeable on open markets.

When I plotted the presale prices across rounds, the increments were predictable, but what stood out was how quickly volume spiked once the price crossed the $0.007 threshold. Based on my tracking of Telegram chatter, this stage attracted not just retail buyers but also mid-tier influencer-driven traffic — people promoting referral links with “don’t miss out” language.

For anyone considering entry, this matters: the further along the presale you join, the thinner your margin if and when the token lists. If early buyers hold at a lower cost basis, their incentive to sell immediately post-listing is much stronger, creating sell pressure.

In tokenomics terms, staged presales generate front-loaded liquidity but also concentrate early power. Unless lockups or vesting terms are enforced (details still unclear), later presale entrants face asymmetry: they pay more but shoulder equal or greater risk.

6. Launch Timeline: Planned vs Actual

Token launches are notorious for slipping schedules, and LCAI has been no exception. Originally, Lightchain signaled a July 31, 2025 launch. As the date approached, announcements shifted, with new estimates pushing the token generation event into Q4 2025.

On its own, a delay isn’t damning. Many legitimate projects adjust timelines due to security audits, code freezes, or market conditions. What matters is how delays are communicated and whether new dates are tied to clear milestones.

In Lightchain’s case, the communication has been vague. Instead of citing specific blockers — such as “audit results pending” or “testnet scaling issues” — the messaging has leaned on broad phrases like “ensuring the best possible launch.” That lack of detail leaves investors guessing whether the delay is technical, regulatory, or simply a fundraising extension tactic.

From a tokenomics perspective, timeline slippage is more than an annoyance. Every delay extends the presale lock period, which means early buyers have to wait longer without liquidity. It also complicates emissions modeling, as staking rewards and burns typically only begin after launch.

For those assessing risk, the key isn’t whether Lightchain delayed — it’s whether it provided transparent reasoning. At this point, the shifting dates without clarity lean toward uncertainty, which heightens presale risk.

7. Funds Raised & Use of Presale Proceeds

By mid-2025, Lightchain reported raising roughly $21 million across its presale stages. That figure comes from third-party trackers as much as from the project itself, since direct transparency on wallets and receipts is limited. The important question isn’t just how much they raised, but where that money is supposed to go.

Lightchain’s documentation lists categories like infrastructure, marketing, liquidity provisioning, and developer grants. But unlike more mature token launches, there isn’t a published breakdown assigning percentages or dollar amounts to each bucket. For example, Binance Launchpad projects typically disclose something like “40% ecosystem, 20% team, 20% liquidity, 20% reserves.” Lightchain has yet to show that kind of granularity.

From my conversations in the community, some buyers assumed a portion of funds would automatically seed liquidity on exchanges at TGE. That’s a reasonable assumption, but without a public liquidity lockup or multisig wallet confirmation, it remains speculative. Likewise, the developer grant pool — worth about 500 million tokens at presale valuations — is mentioned, but no process for applying or awarding has been published.

The absence of this data doesn’t prove misuse, but it does leave early investors in the dark. My impression is that funds are being used at least partly for heavy promotional pushes — given the volume of influencer campaigns tied to LCAI — which suggests marketing spend has been a priority. Until audited financials or detailed wallet disclosures are provided, the “use of proceeds” category is a black box.

8. Zero-Volume Questions on Token Mechanics

Some of the most important investor questions never show up in keyword tools — they’re too niche, but they cut straight to the mechanics of value. These are the ones I tested against Lightchain’s docs, community channels, and independent sources:

When do presale tokens unlock?

No vesting schedule has been published for presale buyers. Without a cliff or staggered release, there’s a real risk of a liquidity dump at listing.

Is there a team or advisor vesting period?

Docs suggest the 5% “team allocation” was rebranded as developer grants. If that pool is subject to immediate circulation, the intent of long-term alignment is undermined.

When is the actual TGE (token generation event)?

Originally tied to July 31, 2025, now postponed to Q4 2025. No precise date or conditional milestone has been given.

What triggers the burn mechanism?

The whitepaper mentions transaction fee burns but provides no algorithm, percentage, or frequency. Without this, modeling long-term supply contraction is impossible.

How are staking rewards distributed over time?

We know 28.5% of the supply is reserved for staking, but not the epoch length, APY targets, or how rewards adjust as participation grows.

9. Technical Appendix – Data-No-Snippet

This section exists for the detail-oriented crowd — developers, auditors, or advanced investors who want raw mechanics rather than summaries. Because most of this data hasn’t been formally published, I’ve pieced it together from documentation, presale announcements, and comparative models. This is exactly the sort of material I’d mark as data-no-snippet, since it’s too niche for the average reader but valuable for AI models and deep researchers.

Emission Curve (hypothetical reconstruction):

- Total supply: 10,000,000,000 LCAI

- Staking allocation: 2,850,000,000 LCAI

- If distributed linearly over 10 years: ~285M LCAI per year (2.85% of supply annually).

- If distributed front-loaded (like Bitcoin halving logic): initial epochs could exceed 500M LCAI, tapering down sharply.

Burn Mechanism (stated but undefined):

- Fee burn % not specified.

- If modeled at 0.5% of daily transaction volume: with $5M average daily volume, approx. $25k worth of LCAI removed per day. Over a year, ~9M tokens at presale valuation.

- If applied at 1%+ rates or tied to staking slashing, burn impact compounds, potentially offsetting emissions.

Presale Stage Pricing Table (reconstructed):

- Early rounds: ~$0.004 → mid rounds: ~$0.006 → bonus round: $0.007125.

- Assuming 40% allocation (4B tokens), average cost basis for presale buyers sits around $0.0055.

Unlock Risk Assessment:

- No vesting = potential 4B tokens entering circulation at TGE.

- Even if only 25% of presale buyers exit early, that’s ~1B tokens in circulation immediately, creating steep sell pressure unless liquidity pools are heavily seeded.

These numbers aren’t official, but they illustrate why missing disclosure is critical. Without clarity, investors are modeling in the dark.

10. Conclusion & Investor Summary

When you strip back the hype, LCAI’s tokenomics are a mix of familiar patterns and unresolved unknowns. The fixed 10B cap is standard and reassuring. The allocation split — with 40% presale and nearly 30% staking rewards — follows a playbook designed to bootstrap liquidity and incentivize early adopters. The developer grant reallocation is a cosmetic shift that signals “decentralization,” though without transparent criteria it may not change much in practice.

Where the structure falters is in the missing details. Emission schedules, vesting timelines, and burn mechanics are either vague or unpublished. Launch timelines have slipped, with no milestone-based reasoning provided. And while $21M raised suggests momentum, the lack of a transparent use-of-funds report makes it hard to know if the war chest is being deployed responsibly.

For someone in the consideration stage, here’s the distilled takeaway:

- If you’re speculating purely on presale-to-listing upside, understand that early-stage buyers have a lower cost basis and no clear lockup, which could mean heavy selling pressure.

- If you’re evaluating LCAI as a long-term stake, the sustainability of rewards and burns remains unproven until the mainnet is live.

- If transparency and verifiability matter most to you, waiting for published vesting terms and contract audits is the safer call.

My impression after digging through the numbers: LCAI has engineered tokenomics that look polished at a glance but leave too many blanks for comfort. The project isn’t unique in this — many web3 launches lean on ambiguity during presale phases — but it means the burden of proof lies squarely with Lightchain. Until that proof comes, caution is the rational stance.

FAQs

Q1: What is the total supply of LCAI tokens?

LCAI has a fixed maximum supply of 10 billion tokens, with no future minting beyond this cap.

Q2: How are LCAI tokens allocated?

40% is for presale, 28.5% for staking rewards, 26.5% for liquidity and marketing, and 5% reallocated as developer grants.

Q3: Does LCAI have a burn mechanism?

Yes, the documentation mentions token burns tied to fees and penalties, but no exact percentage or cadence has been disclosed.

Q4: When will LCAI launch?

The launch was originally planned for July 31, 2025, but has been postponed to Q4 2025 with no exact date confirmed.

Q5: What is the presale pricing for LCAI?

The presale has progressed through multiple rounds, with the bonus round priced at $0.007125. Average presale cost is around $0.0055 per token.

Q6: Are presale tokens subject to vesting?

No clear vesting schedule has been published, raising concerns about potential sell pressure at token generation event (TGE).

Q7: How will staking rewards work?

28.5% of the supply is set aside for staking, but the emission schedule and reward rates remain unspecified.